Market Update

- Rezny Wealth

- Oct 18, 2015

- 2 min read

“You work hard for your money. We’ll work hard to protect it.”

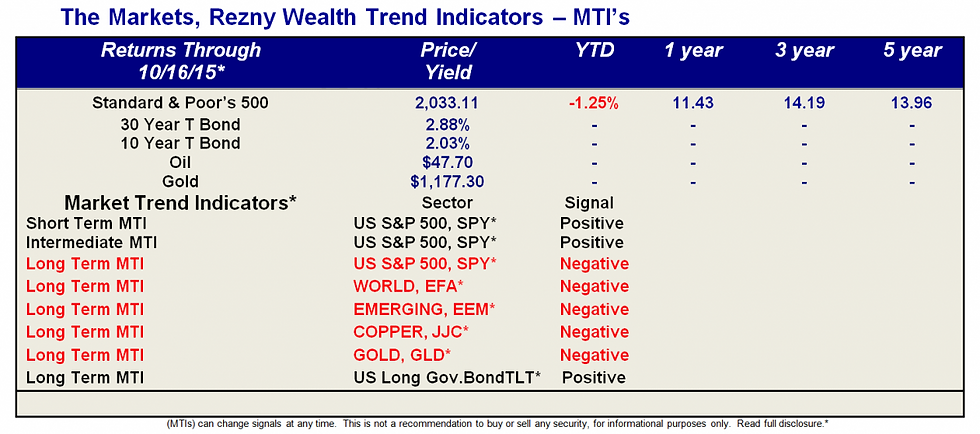

Market Direction Is Important –

Updated Chart of the S&P 500 and Secondary Signals

Of our Four secondary indicators under our MTI:

Relative Strength Index (RSI)-Positive

Chaikin Money Flow (CMF)-Positive

MACD- Positive

Money Flow Index-MFI-Positive

More on the Market and the Economy:

Stocks finished the week higher as the market shrugged off mixed economic data, with the S&P 500 gaining .9% for the week, its third consecutive weekly gain and first three-week winning streak since May.

Source: dshort.com

This week data will be released on housing starts, existing home sales and the Conference Board’s leading economic indicators.

The Federal Reserve’s latest Beige Book reported “continued modest expansion in economic activity during the reporting period from mid-August through early October” as “consumer spending grew moderately”. The report also noted that “manufacturing turned in a mixed but generally weaker performance”.

Speaking last Tuesday, St. Louis Fed President James Bullard said that the Fed should start gradually raising rates: “Prudent monetary policy suggests gradually edging the policy settings closer to normal, since the goals have been met and policy would still remain very accommodative”. He said that an accommodative stand will “provide plenty of insurance against any remaining risks to the U.S. economy”.

The Atlanta Fed’s GDPNow is forecasting .9% growth for the third quarter, lowered from 1% following last week’s retail sales report.

The Treasury Department reported last week that the fiscal year 2015 budget deficit totaled $439 billion, which is around 10% lower than FY2014, and 70% lower than the peak in 2009. Still, a 70% decrease over 6 years isn’t as good as it sounds when factoring in the 800% increase that brought the deficit to a record.

Last Thursday, Treasury Secretary Jack Lew wrote his ninth letter to Congress this year requesting action on the debt limit, stating that “based on our best and most recent information, we now estimate that extraordinary measures will be exhausted no later than Tuesday, November 3. At that point, we expect Treasury would be left with less than $30 billion to meet all of the nation’s commitments”. He also noted that “operating the United States government with no borrowing authority, and with only the cash on hand on a given day, would be profoundly irresponsible…we anticipate that a remaining cash balance of less than $30 billion would be depleted quickly”.

The International Energy Agency cut its forecast for oil demand growth for 2016 by 200,000 barrels per day, noting that “a projected marked slowdown in demand growth next year and the anticipated arrival of additional Iranian barrels–should international sanctions be eased–are likely to keep the market oversupplied through 2016”.

According to the NAHB, the median size for new homes in 2014 was 2,450 square feet – the second-highest measure since 2009.

Comments