Market Update

- Rezny Wealth

- Oct 12, 2014

- 2 min read

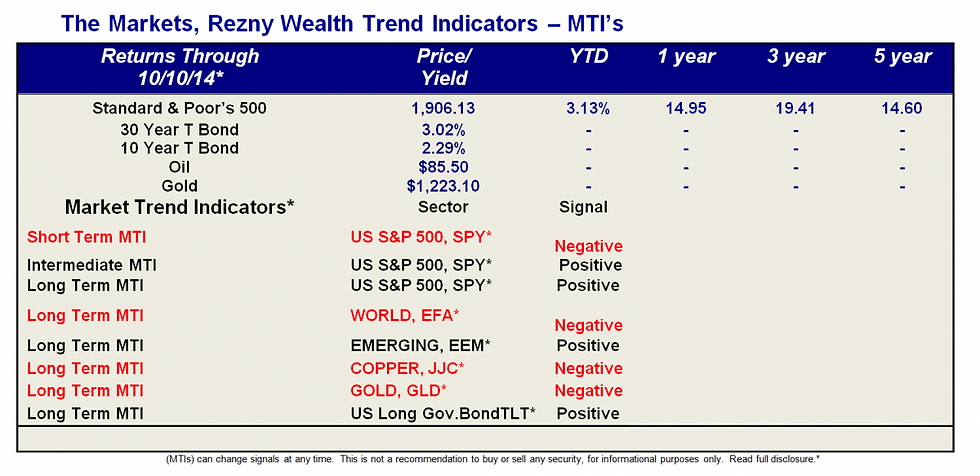

Market Direction Is Important –

Updated Chart of the S&P 500 and Secondary Signals

Of our Four secondary indicators under our MTI:

Relative Strength Index (RSI)-Negative

Chaikin Money Flow (CMF)-Negative

MACD- Negative

Money Flow Index-MFI-Negative

More on the Market and the Economy:

At the end of what can only be described as a volatile week, the S&P 500 posted a 3.1% drop – its biggest weekly loss in two years (and its third straight weekly decline). The Dow ended the week down 2.7% and erased its gains for the year.

It was a rough end to a choppy week: on Wednesday the market rallied following the release of the minutes from the last Fed meeting, which hinted that the central bank may move more cautiously on raising interest rates. A number of officials worried that growth “might be slower than they expected if foreign economic growth is weaker than anticipated”. Several participants were concerned that “inflation might persist below” the Fed’s 2% target for “quite some time”. The S&P 500 posted a 1.75% gain for the day – its best day since October 2013.

The biggest rally of the year turned into an ugly sell-off on Thursday, with the S&P 500 plunging over 2%, and the Dow suffering its worst one-day sell-off in over a year.

Source: dshort.com

The CBOE Volatility Index, a gauge of fear in the market, hit a 52-week high and surged 46% for the week.

Next week, the market will see data released on small business optimism, retail sales, industrial production, housing starts and the Fed’s Beige Book.

The International Monetary Fund cut its forecast for global growth for 2014 and 2015, with a warning that “growth is uneven and still weak overall and remains susceptible to many downside risks”. With the release of the latest World Economic Outlook, the IMF expects the world economy to grow 3.3% this year, and 3.8% next year, compared to a previous forecast of 4%.

While “emerging market and developing economies will continue to account for the lion’s share of global growth”, the forecast for emerging markets was cut to 4.4% this year and 5% next year, as “emerging markets are adjusting to rates of economic growth lower than those reached in the precrisis boom and the postcrisis recovery”.

The IMF sees the US as a bright spot among advanced economies, raising its outlook for growth to 2.2% for this year, from a previous projection of 1.7%, noting that “employment growth has been strong, and household balance sheets have improved amid favorable financial conditions and a recovering housing market”. The US is expected to grow 3.1% next year.

The report comes less than a month after the OECD cut its forecast for the global economy.

Comments